Hello friends, if we talk about Google Pay, it has already covered a huge market in India.

And why not, the features are such that Google has provided all the features in it keeping every user’s needs in mind.

Google Pay is not just a money transfer app, it has now become a complete financial service provider.

In this, not only money transfers, recharges, loans, bill payments, etc., but many other services will be available.

Today I will give you detailed information about Google Pay.

In this post, you will read what Google Pay is and how to use it.

You will also get a chance to know about its excellent services.

And how you can easily generate income through Gpay.

You will know all this.

What is Gpay? or Google Pay?

Gpay i.e. Google Pay is a product(app) of Google itself that provides a facility to do QR payment, UPI money transfer, recharge, insurance, and almost all types of financial transactions like Paytm and Phone Pay.

Gpay was first launched by Google with the name Tez, which was later changed to Gpay.

Google Pay is a UPI-based digital payment application specially designed for India.

Gpay was launched in India as Tez on 18 September 2017.

However, after a few months, on August 28, 2018, Google changed the name of Tez to Google Pay.

According to the Google search engine, Gpay will have 5.67+ million active users in India in 2023.

How to use Google Pay?

To use Google Pay, you will need a bank account, a bank-registered mobile number, and a Gmail account.

If even one of these things is missing then you will not be able to use the Google Pay app.

To use the Google Pay app on your mobile, follow the steps given below.

So you want to know how much Google Pay has changed in 2003. And how to use it.

So friends, the way to use Google Pay is very simple.

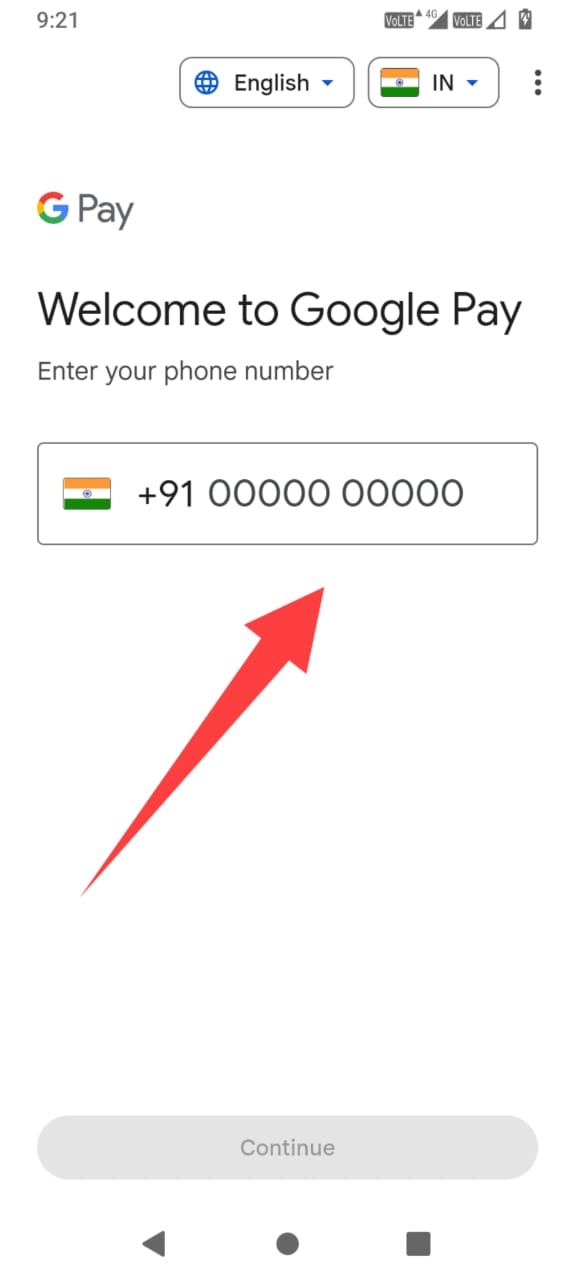

First of all, install the Gpay app on your mobile from the Play Store.

Open Gpay.

The first page will open in front of you.

Enter your bank-registered mobile in it and click on continue.

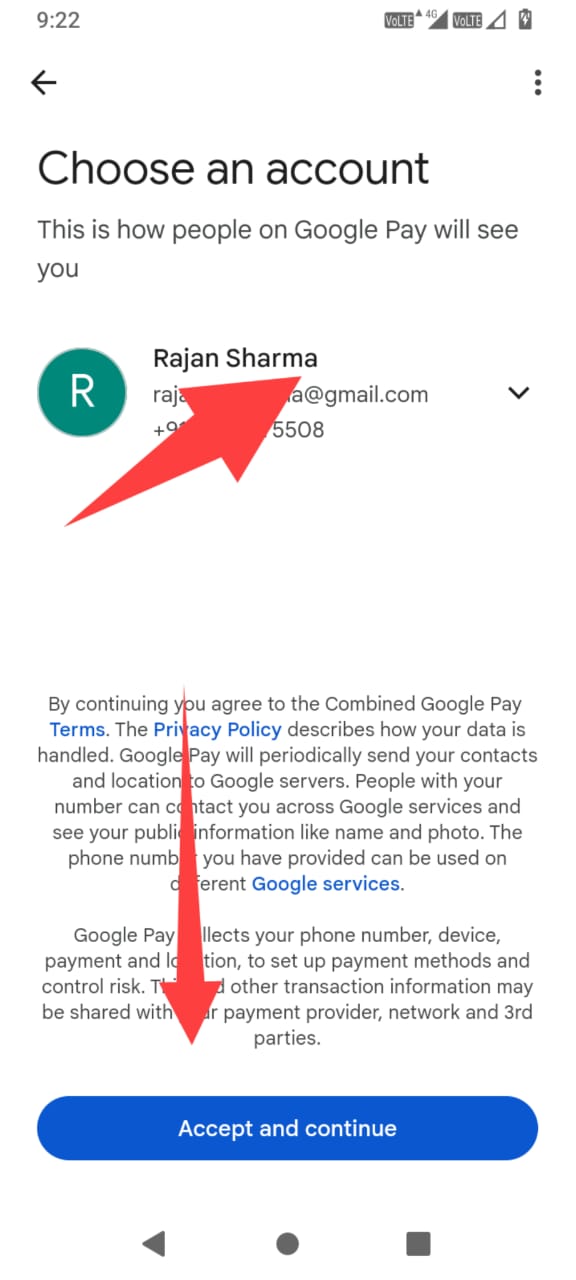

After this, on the second page, you must select your Gmail account for your Gpay. Here select the account and click on accept and continue.

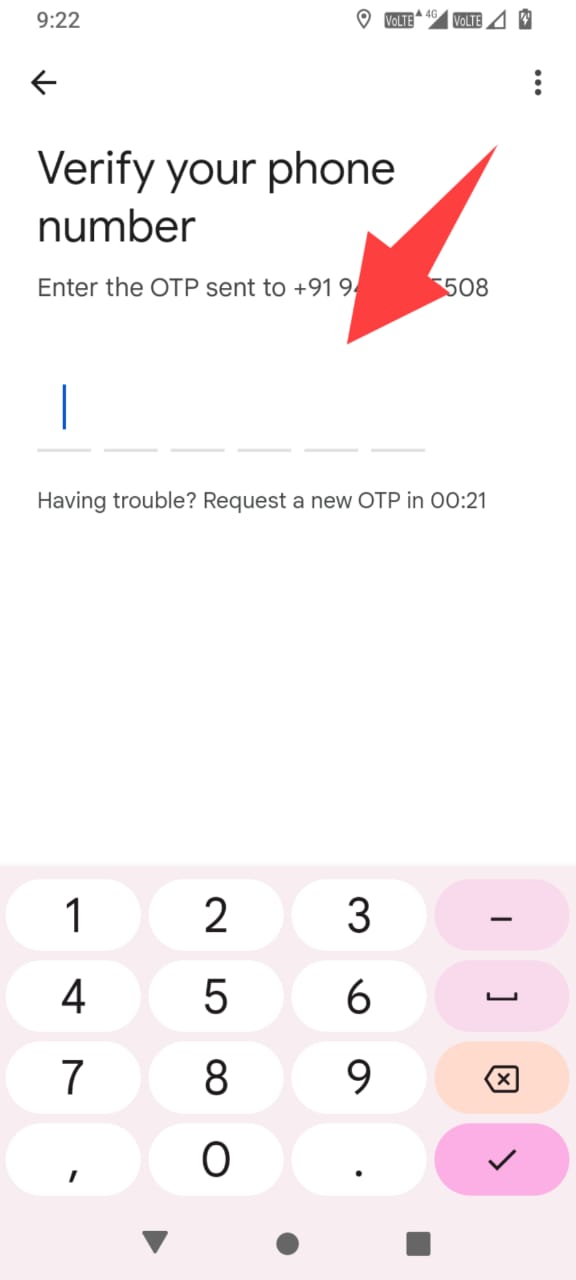

On the next page, you will have to verify your phone number through the OTP verification process.

So now your Gpay interface will open. It will look something like this.

How to add a bank account in the Google Pay app.

To use it fully, you will have to add your bank account to it.

In the interface of Google Pay, you will see the option to add a bank account. (If the add bank account option is not visible then open the settings of the Gpay app)

Find the Add Bank Account option and click on it(See the below image ).

On the next page that will open, you have to select your bank account. (In this you search and select your bank account)

A message-sending process will be done automatically from your mobile through which your account will be added to the Gpay app.

(Here let me tell you that the process of finding a bank account is done just through your bank-registered mobile number.)

A Bank account has been added, now you have to create UPI PIN to start your digital payment journey on Gpay.

How to create and change UPI PIN in Gpay.

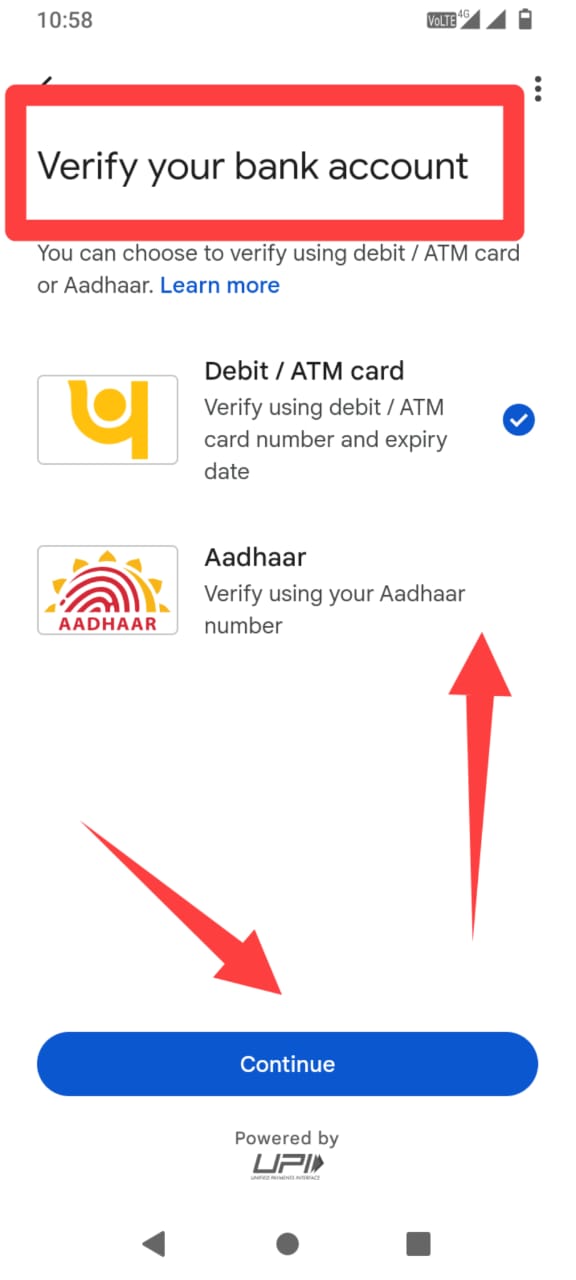

There are two ways to create UPI PIN and UPI ID in the Gpay app.

Firstly, you must have a debit card from that added bank.

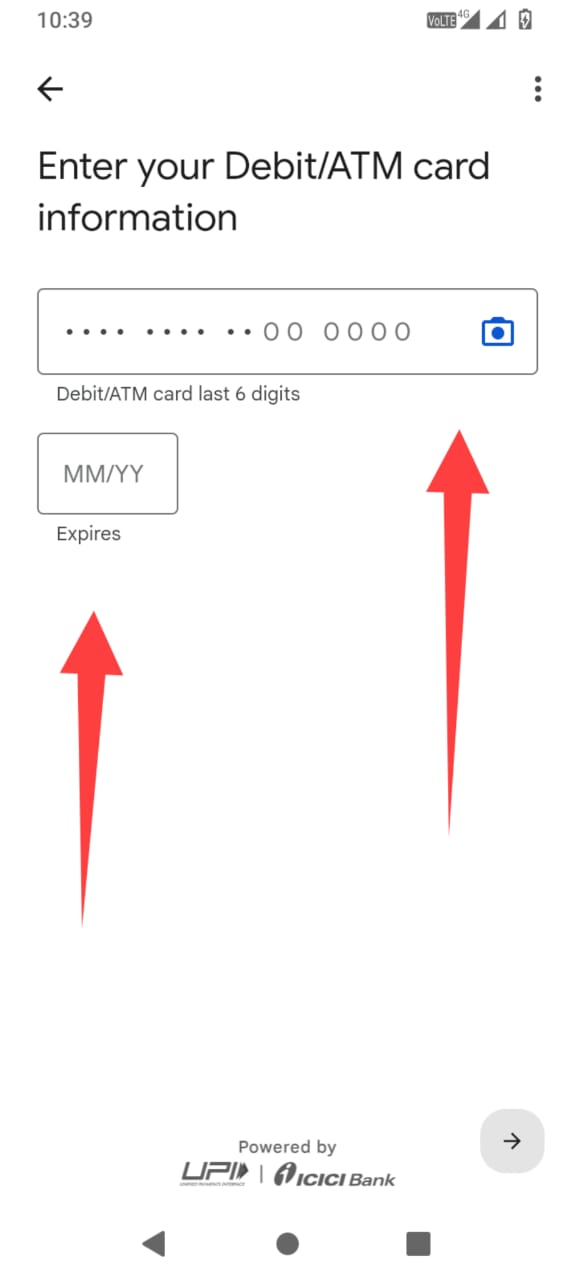

Creating a UPI PIN from a debit card is quite easy.

You have to enter the last six digits of the debit card and

Also, the expiry date of the debit card.

Along with this, you can also enter the PIN of the debit card.

An OTP will be generated.

After entering the OTP, you will be asked to select the UPI pin.

The second method is By using your Aadhaar Card,

you can create a UPI PIN through your Aadhaar number.

Secondly, your Aadhar card should be attached to the bank account. (Also Keep in mind that the mobile number must be registered in your bank account.).

If you do not have a debit card, you can also create a UPI PIN by verifying your account with an Aadhar card and Using your Gpay app.

Sending and Receiving Money through Gpay

So now, you have learned a lot about Gpay.

The most common work of the Gpay app is to transfer and receive money.

There are some limits on money transfers and receiving in the Gpay app.

If you are a new user then your money transfer limit will be much less but with time your limit will also increase (by the way, the maximum money transfer limit of Gpay is one lakh for 24 hours) and you can do 10 UPI transactions and that too for 24 hours.

You can transfer money through Gpay in many ways.

- Through QR code

2. Through mobile number

3. Direct to a bank account

4. Through UPI ID

The limit for requesting money through Gpay is only Rs 2000. One reason for this low limit is that no major fraud transactions occur through Gpay.

Other best features of Gpay(Google Pay ).

As I have told you the Gpay app is not only made for digital money transfer and receiving but it gives you a complete finance solution.

You can apply for a loan through Gpay and that too in an effortless way. You can also check your CIBIL score in Gpay and that too for free. For your information, let me tell you that a good CIBIL score is helpful for you to get a loan quickly.

Gpay you can pay postpaid bills, credit card bills, fastag recharge, landline bills,

You can also pay electricity bills, loan EMI, etc.

How to earn money from Gpay

you can also earn money from Gpay. you get offers and cashback in the Google Pay app, but apart from this, you can also earn direct income from Gpay.

For this, you will have to go to the Gpay referral option and get your friends and family to install Gpay through your referral link.

If they join Gpay through your referral link, then as soon as they transfer money of Rs 100(or after the first digital payment), you will get Rs 200 from Google which will be directly transferred to your bank account.

Google gives you Rs 200 for every successful referral.

So, friends, You can earn up to 100 rewards and ₹9,000 INR in a financial year.

Is UPI Lite available in GPAY? How to activate UPI Lite in Google Pay

So You would like to know what is UPI Lite feature.

For your information, let me tell you that the UPI Lite facility was launched by the Reserve Bank of India in September 2022 to ease the online payment process and it has been enabled by the National Payments Corporation of India (NPCI).

Now Google has also enabled this feature in Gpay. This is a completely new update in Gpay.

With the Gpay UPI Lite feature, you can make any digital payment of up to 500 ((Previously ₹200) INR without entering a UPI PIN. (Meaning that it will make your payment process quite simple and fast .)

Gpay Lite Feature

In the Gpay UPI lite, you can load up to Rs 2000 and do a maximum transaction of Rs 4000. In 24 hours.

This limit has been kept low so that no major fraud can occur by using Gpay UPI Lite.

You should also know that other platforms like PhonePe and Paytm have already rolled out the feature on their platforms. As of now, 15+ banks support UPI Lite.

How to activate UPI Lite in Google Pay

It is quite easy to use the UPI lite feature in Gpay.

Open the Gpay app and go to the Gpay lite feature.

In the next interface that appears, load the money as shown and click on the add button.

(You can see this in the image given below).

Writer Words –

So my dear friends,

You have learned a lot about how to use Google Pay through this post.

As you know, Google Pay is not just a digital payment app, it is a complete platform for all types of digital and financial payments and You can also earn by using it.

I have been using Google Pay app for the last five years and it has never disappointed me. In this, you will get every kind of feature as per your need.

Although PhonePe and Paytm are also very popular digital UPI payment apps. But Gpay is something different.

So if you want to know new information about Google Pay or other Google services, then you can tell us by commenting.

Thanks for reading the post.

Also, read

Become a Power Searcher with Google Search Lab AI?

How to add a business on Google Maps in 2023

“The Google Store: A Step-by-Step Guide to Buying Products Online”

How to Access, Navigate, and Leverage YouTube Advanced Settings for Ultimate Control